The ESG Marketplace Matures

The pressure is on for enterprises to become more sustainable. But selecting the right tools and knowing where to focus can be frustrating. Breaking down ESG requirements is a critical step in finding the right ESG vendor.

What was once a crawl toward environmental, social, and governance (ESG) performance has suddenly become a sprint. Organizations large and small are discovering that tools and technologies that support ESG are essential for regulatory compliance, managing costs, and assembling sustainability data that consumers use when making buying decisions.

Selecting the right ESG tools can easily become a trip down the proverbial rabbit hole, however. ESG covers an extremely broad area and consulting firms, ERP providers, and independent vendors offer different tools that deliver different features. “It’s a very fractured space,” observes J.R. Vanorder, a principal in the Climate Change and Sustainability Group at consulting firm EY. “The result is a lot of noise.”

Sorting through all the options is essential, particularly as organizations strive to meet aggressive climate targets. While major ERP applications typically include basic tools for carbon tracking or gauging social impacts, there’s no single ESG tool that addresses the scope of issues that span stakeholders and initiatives. Moreover, “Factors and drivers vary greatly by region,” states Chet Geschickter, a vice president and analyst in the CIO Group at Gartner.

ESG Is More Than Product Features

For many companies, the challenge starts with a tendency to view ESG as a check-the-box task. But underneath this is a need to electrify vehicle fleets, source more sustainable materials and reach diversity goals. However, focusing too heavily on reporting and compliance can undermine broader goals and sabotage revenue growth. “There’s a growing recognition that ESG can drive business performance,” Vanorder explains.

B corporations, which build sustainability into their charter, aren’t the only entities embracing this world view. “Organizations are starting to ask how they can use ESG to differentiate products and services, and, in some cases, charge higher fees for improved performance,” Vanorder says. “Consumers are increasingly demanding data about how organizations are mitigating climate risk or achieving social goals.”

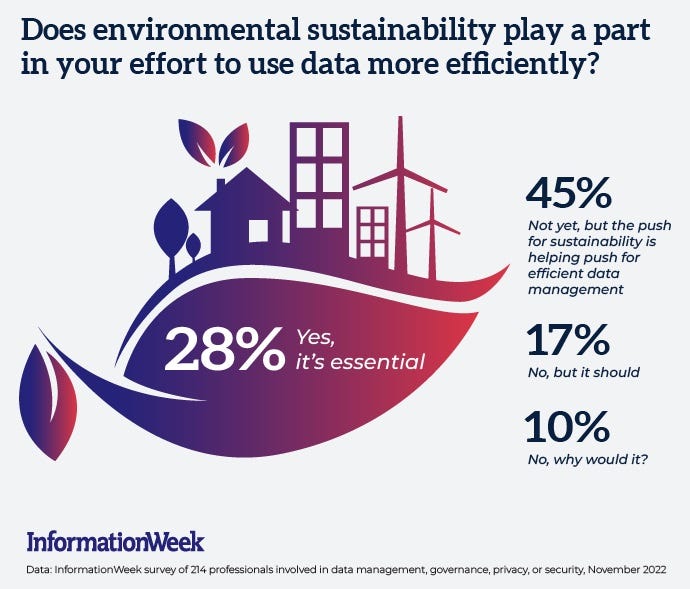

Plucking the right data can prove daunting because different ESG software packages approach tasks in completely different ways. Some offer basic reporting tools, others include analytics and AI features, and still others support third-party data collection and automation that can guide decisions around Scope 2 and Scope 3 emissions. As organizations look to pull all these elements together, complexity and data inconsistencies can surface.

The good news, says John Mennel, sustainability strategy leader and managing director at Deloitte Consulting LLP, is that these tools are rapidly advancing. They’re becoming more accurate, time-sensitive, and transparent. “Rather than high-level averages, they are pulling real data from individual buildings, individual pieces of machinery, individual suppliers, and other sources. Rather than reporting once a year, they’re supplying data as often as every 15 minutes -- including upstream and downstream across partners and supply chains.”

Deloitte, like many consulting firms, offers its own tools for setting decarbonization targets and identifying sources for R&D and actual products. Yet, regardless of the exact tool or technology a business uses, Mennel suggests adopting a framework that delivers a broad and highly flexible view. “Executives should be focused on implementing a holistic, integrated data and insights program to measure and drive environmental sustainability,” he says. This includes streamlined reporting that board members can use to guide critical decisions.

Thinking Out of the Box in the ESG Marketplace

Breaking down ESG requirements is a critical step in finding the right ESG vendors. For instance, some software providers specialize in environmental, health, and safety issues while others are tuned into governance, risk and compliance (GRC). Some ESG tools are better for carbon tracking and sustainability while others are designed to address social governance goals. The way packages collect, store, and manage data can also vary greatly -- and some are designed for specific industries.

When shopping for ESG solutions, a key consideration is identifying tools and features that map to the specific data a company needs to meet internal objectives or industry-wide regulatory requirements, Geschickter says. This process should include a materiality assessment, which identifies which E, S, and G issues are the most crucial for the organization. “This is a foundation for establishing a problematic focus and closing gaps in data,” he says.

Of course, data accuracy is nothing less than critical. Ideally, software can map to multiple standards. An organization must have a way to address data verification and validation through data checks, data cleansing, and data normalization, Geschickter notes. One of the principal ESG accounting challenges involves sometimes vague and inconsistent methods that are used to generate and collect data. ESG packages may use averages or different formulas to calculate a figure.

At the same time, it’s crucial to maintain a forward-thinking view and have the flexibility to grow and change. As new regulations and requirements appear -- particularly surrounding sustainability -- a business must respond. For example, right now the focus is heavily on carbon output, Vanorder says. “But we’re starting to see the need for tools to track water scarcity, biodiversity, plastic taxes, human rights, and health equity.”

Measuring ESG Progress

Developing an ESG framework isn’t a task to take lightly. Software packages guide progress which defines results. What’s more, “The larger the enterprise and the more complex the measurement criteria—including KPIs, dashboards and visual representations -- the more thought and energy needs to go into the process,” Geschickter explains.

What’s more, an organization may require additional analytics tools that extend beyond commercial software. ESG data increasingly stream in from multiple sources, including enterprise CRM and SCM systems. Yet various other technologies, including analytics programs, advanced AI frameworks, IoT sensors, distributed ledgers, and clouds can also deliver essential data. “Many of these products now include applications to aid in decarbonizing,” he says.

Culling expertise from different groups within an organization -- with a chief ESG officer connecting all the dots -- can help identify ESG requirements. Within most organizations, “There are people who have expertise. They can provide insight into essential requirements and understand how well a specific solution fits the organization’s business requirements. With an RFP and a shortlist of providers, a business can confidently move to the implementation stage.”

To be sure, ESG is a data collection exercise -- yet it can also serve as a mechanism for growth, Geschickter says. “Organizations that get a head start on digitizing data and plugging it into systems are better equipped to face the growing array of regulations and requirements,” he says. “At the same time, they’re able to tie initiatives into financial performance and understand tradeoffs and scenarios that lead to increased business performance and sustainability.”

What to Read Next:

Software in a Sustainable World

About the Author(s)

You May Also Like

How to Amplify DevOps with DevSecOps

May 22, 2024Generative AI: Use Cases and Risks in 2024

May 29, 2024Smart Service Management

June 4, 2024